HHG Investment Committee Chairpersons Update

There was a lot to discuss at HHG’s recent Investment Committee Meeting. The market has been relatively volatile of late, with trade wars dominating the market discourse.

Having said that, lower interest rates were also discussed. Part of that discussion focused on how lower interest rates are making the listed property sector a more attractive investment option.

The Committee also added some guidance to help our advisers build suitable KiwiSaver products for our clients. As you may recall from previous newsletters, HHG has partnered with KiwiWRAP to provide our clients with bespoke KiwiSaver portfolios that reflect their values, goals, objectives and tolerance to risk. This product provides advisers the ability to select specific companies or funds from a range of over 400 options. The guidance provided focused on narrowing down the above 400 options to a core list of funds based on specific criteria. The evaluation criteria included fees, issuer credibility, index alignment, and investment methodology (balancing active and passive strategies).

Whilst the HHG advisers and clients have final say about what is included in their KiwiSaver portfolios, the core funds are designed to provide a solid base to build a portfolio from. Next is an example of one such core fund. Next is an example of one such core fund.

Vanguard Total World ETF (VT.US)

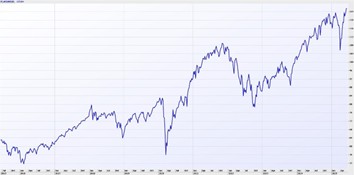

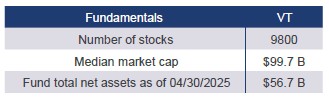

The Vanguard Total World ETF offers investors a simple, cost-effective way to gain exposure to both developed and emerging equity markets across the globe. By tracking the FTSE Global All Cap Index, it provides broad diversification across thousands of companies, making it a strong foundational holding for long-term investors seeking global equity exposure. With an annual underlying investment fee of just 0.06%, it is also one of the most competitively priced options in its category.

This ETF is particularly well-suited for those looking to streamline their portfolios while maintaining comprehensive market coverage. Its passive investment strategy ensures alignment with global market performance, and its inclusion of both large and mid-cap stocks across various regions helps mitigate regional and sector-specific risks.