In recent weeks all of us would have seen, heard, or read about the current situation involving Russia and Ukraine. We know that various sanctions have been imposed and imports to, and exports from these countries have been made more difficult.

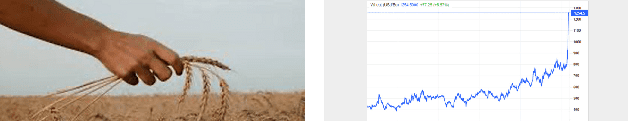

What is less well known is Russia and Ukraine are responsible for around a quarter of the world’s total wheat exports which are likely to be interrupted if the situation persists. We are already seeing many commodity prices increase, including wheat prices with a highly likely rise in the cost of food to follow. Source – www.tradingeconomics.com/commodity/wheat

For some commodities, investors can buy shares in companies involved with the production or supply of that commodity. A good example would be buying a mining firm to take advantage of increases in metals prices. Another way to gain exposure could be to consider investing into an ETF – Exchange Traded Fund. These investments can give you exposure to the sector or asset of your choice enabling you to benefit from the expected price rises. They are available for assets such as Gold, Silver, Oil and Agricultural commodities.

If these types of alternative asset interest you, please speak to your Hamilton Hindin Greene adviser and they will be happy to help work through potential options that meet your needs.