Corporal Jones of Dad’s Army and the Hitchhikers Guide to the Galaxy had one thing in common – both said, “Don’t Panic!”. It is not always easy to remain calm when markets are volatile, but for longer term investors the current market movements are not necessarily to be feared. Indeed, there may be opportunities to top up existing holdings at lower prices. Looking back at the last 50 years or so there have been a number of market shocks but recovery always followed, such as the 1987 Crash, the Global Financial Crisis of 2008 and the Covid pandemic of 2020.

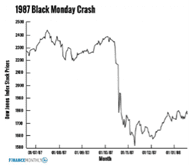

Black Monday, October 1987

Legislative changes on 14th October 1987, and a high trade deficit figures in the US triggered a fall in the US Dollar. Moves by the US Federal Reserve to increase interest rates, to support the dollar, pushed stock values down over the course of the next three days and over the weekend more investors took the decision to sell. On Monday 19th October 1987, a huge wave of selling triggered a 22% fall in New York. All markets were hit hard but this event is barely visible on charts today.

At the peak of the crash the Dow Jones index in the US fell to just over 1500 points and took 648 days to recover to its pre-crash level. Compare that to today’s value of over 33000 points. Such an event is less likely to occur nowadays as improvements in technology and trading halts if shares move by more than a certain amount function as a safeguard.

The Global Financial Crisis of 2008

Anyone who has seen the film “The Big Short” will understand that easy credit, particularly for US housing triggered a bubble that few people saw coming. Large institutions with billions invested in mortgage bonds found their investments were nowhere near as safe as they thought, and high levels of lending by Banks saw them struggling for capital as credit dried up.

Rapid intervention by Central Banks ploughed money into the markets and narrowly averted complete meltdown, but the stock market falls were understandably huge. Many of us will remember this time clearly.

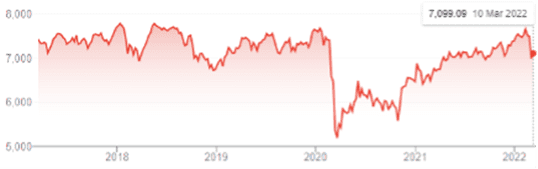

But how badly was the New Zealand market affected?

Unlike other markets with greater exposure to Banking, New Zealand was hard hit but not as badly as the US or European markets. Despite the enormity of the event, it does not look that catastrophic on a longer-term chart. Recovery to pre-crash levels took approximately four years but look how we have done since. You can also see the drop in 2020.

The Covid Pandemic

One event we are still living through is the Covid pandemic. From its outbreak in late 2019 to its global spread today it has affected all our lives. Markets also reacted as the virus spread as illustrated by this FTSE 100 chart in London:

An investor called Ken Fisher, founder of Fisher Investments is frequently quoted as saying “Time in the market beats timing the market” as any investor who held their nerve in 1987, 2008, and 2020 will testify. Don’t forget that equally well-known quote from Corporal Jones.

Don’t Panic!