Key Takeaways:

- Ebos Group’s shares experienced a significant decline of 9.8% after losing a major A$1.9 billion contract with Chemist Warehouse, resulting in a market value reduction of $776 million.

- The lost contract represents more than a tenth of Ebos Group’s annual revenue of A$10.7 billion and will expire by the end of June 2024.

- Ebos Group’s CEO, John Cullity, acknowledges the risk associated with contract renewal and emphasizes the company’s focus on minimizing earnings impact and exploring alternative growth opportunities.

- To mitigate the impact of the lost contract, Ebos Group plans to expand wholesale supply to other pharmacies, enhance the TerryWhite Chemmart network, and review costs across the affected community pharmacy unit and the entire group.

- The pharmaceuticals supply contract regained by Sigma, the previous holder before Ebos Group, was secured by offering equity worth A$81.5 million and the option for Chemist Warehouse to acquire assets worth A$24.5 million or receive the equivalent value in cash. This deal is expected to generate a combined revenue of at least A$3 billion in the first year, encompassing pharmaceuticals and fast-moving consumer goods.

Extended Summary:

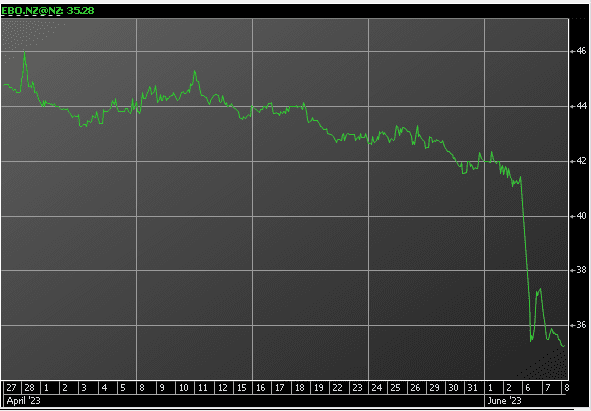

Ebos Group witnessed a significant drop of 9.8% in its shares following the loss of a major contract to supply pharmaceuticals to Chemist Warehouse, a discounter pharmacy chain. The A$1.9 billion (NZ$2.06 billion) contract, accounting for more than a tenth of Ebos Group’s annual revenue of A$10.7 billion, will expire at the end of June 2024. This development caused the company’s shares to decline by $4.05, reaching $37.41, resulting in a market value reduction of $776 million and bringing the company’s total value to $7.17 billion.

Ebos Group’s CEO, John Cullity, acknowledged the risk associated with contract renewal and stated that the company has been working on strategies to minimize the earnings impact and explore alternative growth opportunities. Cullity expressed confidence in the growth strategies for the healthcare and animal care sectors, as well as the overall diversity of the group’s earnings.

To mitigate the impact of the lost contract, Ebos Group is considering options such as expanding wholesale supply to other pharmacies and expanding the TerryWhite Chemmart network. The company also plans to review costs within the affected community pharmacy unit and across the entire group.

The pharmaceuticals supply contract that Ebos Group lost was regained by ASX-listed Sigma, the previous holder before Ebos took it over in 2019. Sigma managed to secure the contract by offering equity worth A$81.5 million, equivalent to 10.7% of the company, along with the option for Chemist Warehouse to acquire assets worth A$24.5 million or receive the equivalent value in cash. This deal will deliver a combined revenue of at least A$3 billion in the first year of the five-year contract, covering both pharmaceuticals and fast-moving consumer goods.

Sigma’s CEO, Vikesh Ramsunder, expressed the significance of securing the contract, noting that it provides real scale and momentum to the company. He highlighted Sigma’s efforts over the past year to enhance operational performance for the benefit of all customers.