I hear the economy is doing better than expected so why are share markets down?

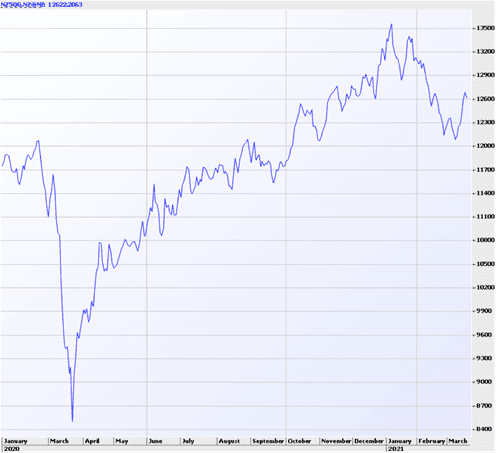

When markets fell in February and March last year, it was crystal clear to everyone why this was happening. We had been plunged into lockdown, economists were expecting house price falls of at least 10% and toilet paper seemed to have suddenly become much more valuable. It certainly wasn’t fun watching the markets fall so quickly, but it was very easy to understand why it was happening. It also turned out to be very short lived – the market fell dramatically for about a month, but since the NZ50 index bottomed on the 23rd March 2020, it was, more or less, one-way traffic for the rest of the year. In fact, by August the share market was back to pre-covid levels and by the start of January 2021 it was over 12% higher than these levels. This was made all the more amazing by the fact that for most of the year the economic data was some of the worst ever seen, economies were in and out of lockdowns, COVID continued to rapidly spread and America was on the brink of civil war.

Since those final few months of last year, the news has been surprisingly positive. We have seen an incredibly fast (and so far, effective) vaccine production, house prices have been so strong they have required government intervention, and economic indicators such as GDP and consumer spending have been beating expectations. So why have share markets fallen?

Essentially, for the same reason they rose last year. When economic activity ground to a halt last year, governments and central banks responded by massive amounts of fiscal stimulus (wage subsidy, stimulus cheques, “shovel ready projects” etc.) and the slashing of interest rates. Lowering interest rates is an effective and simple way for central banks to encourage growth; it makes borrowing much cheaper and saving much less attractive, which should encourage businesses and households to spend and invest.

Lowering interest rates also increases the price of assets, due to the models/equations used to value them. With regards to the share market, it has a particularly strong effect on two types of shares at opposite ends of the spectrum; those that pay high dividends, and those that pay low (or no) dividends, i.e. high growth companies. Rather than bore you with the models and equations, two simplified examples can show why this happens;

- Let’s say interest rates are at a level that term deposits pay 3% for 1 year. Company A is worth $10 and pays a dividend of $1, giving it a high dividend yield of 10% ($1 / $10 = 10%). Investors value this company at such a level that they need a 7% premium on term deposit rates to take on the additional risk of these shares. Now pretend interest rates drop to a level where the term deposit rate for 1 year is now only 1%. If investors still only require a 7% premium, then they are now willing to invest in Company A for an 8% dividend yield. Company A’s dividend of $1 has not changed, so investors will bid this company up to $12.50 ($1 / $12.50 = 8%).

- Company B, on the other hand, doesn’t pay any dividends. It is a high growth company, and investors are investing this company due to the expectation of high future returns (companies like Facebook, Amazon and Netflix for example, took many years to post a profit). If interest rates are high, i.e. you can get 4% on a 1 year term deposit, then these future returns aren’t as valuable, because if you had the money now, you would be able to invest it and it be worth more at the end of the year. When interest rates drop, the value of these high growth companies increase, this is due to the fact that you are not missing out on as much, making the future returns more attractive.

Up until the end of last year, the market was expecting rates to drop even further, and at the very least stay where they are for a few years. Now, because of all the fiscal stimulus and positive economic data, markets are starting to expect inflation and therefore price in rate increases (not until next year at the earliest, but the share market reacts immediately to future expectations). This reverses the effects shown in the previous examples, and has meant repricing some of NZ’s biggest companies (dividend payers like the electricity and property companies, and growth companies such as a2 Milk and Fisher and Paykel Healthcare) and leading to a pretty dramatic fall in the NASDAQ index, which is made up of high growth technology companies.

The good news for investors, is this is nothing to panic about. Over the course of your investment lifetime, there will be many changes in interest rate expectations, some of which will cause your portfolio to rise, and some will cause it to fall (just like when the NZD rises or falls and affects the value of your global assets). The most important thing is to make sure you have a portfolio that is well diversified, between asset classes, countries, sectors and companies, so as that no one change affects your whole portfolio in the same way.