2022 will go down in history for a number of reasons (Ukraine, energy/ commodity price volatility, UK Prime Minster turnover, Covid finally breaking through in numbers in NZ, and a record drop in house prices among other headlines) but from an investor’s perspective, the biggest story has been the return of inflation and the flow on effect this has had on asset and bond prices.

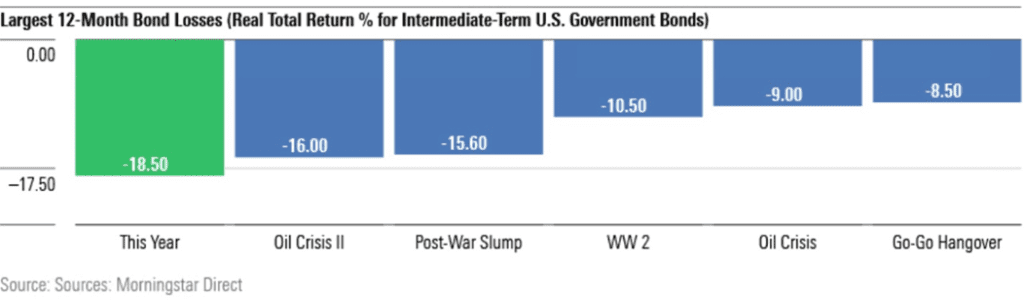

In fact, 2022 is the worst year on record for bond returns both locally and around the globe. You can see from the table below that US Government Bonds have had a worse year this year than they saw during world wars and previous oil crises.

Local bonds have found the going tough as well. As of the time of writing, 86.5% of the 148 fixed interest securities listed on the NZX are trading under-par. Those that are trading above par were either listed years ago at higher interest rates, listed recently when rates have recovered, or have a resettable component that give them exposure to rising rates.

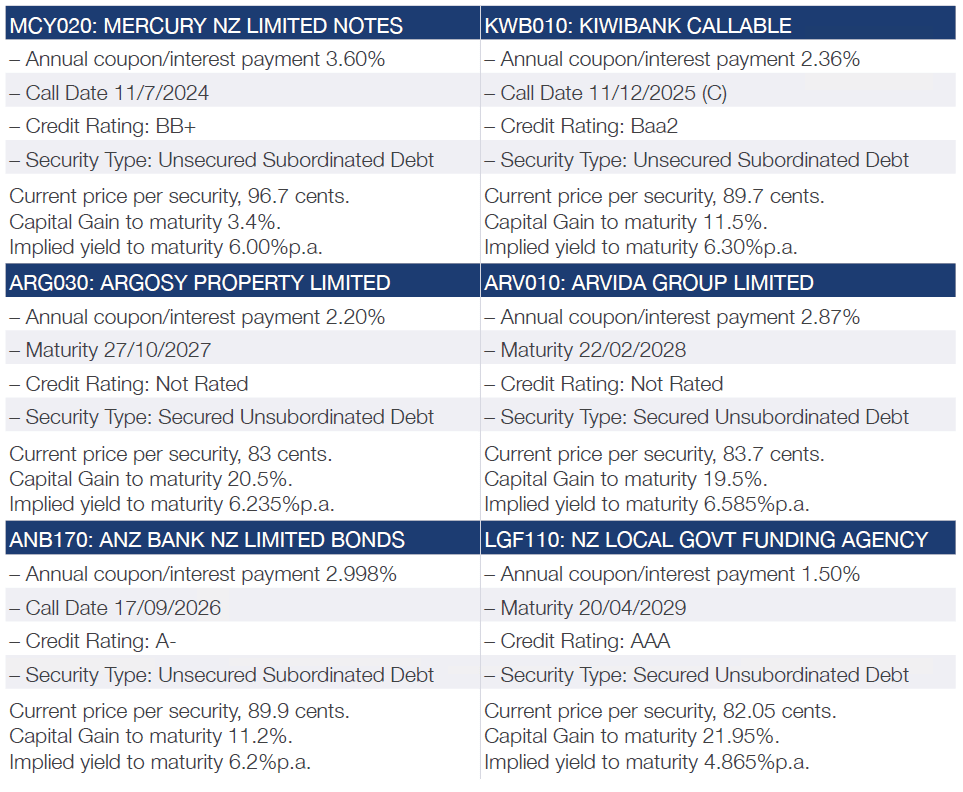

Today we are going to have a look at the bonds that make up the majority of the market many of which are under their $1 issue price.

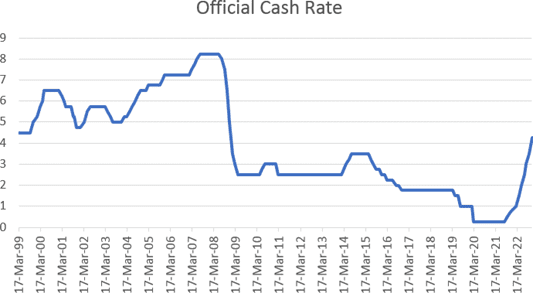

Firstly, the reason these bonds are trading under-water (under $1) is the historic move up in interest rates. This time last year, the Official Cash Rate had just begun to move up, sitting at 0.75%, having sat at record 0.25% for two and a half years.

Currently the Official Cash rate is 4.25%, with a forecast for the rate to rise to 5.5% next year. The current yield of bonds on the market reflects this current rate and those forward expectations. This means that waiting for rates to rise further may not actually see you get better returns, as the market already expects these rate rises (and they are therefore factored into market prices).

Going back 12 months, bonds were being issued based on expectations rates would rise to fight inflation, however at the time the Reserve Bank of New Zealand only expected to need to raise rates to approximately 2.5% towards late 2023.

Clearly these forecasts were wrong, and inflation was much more pervasive, which means rates have need to rise much higher, much faster.

This unexpectedly aggressive rise in interest rates means that any bond issued in the preceding 2 or 3 years is likely to be under-water (i.e. trading below its issue price).

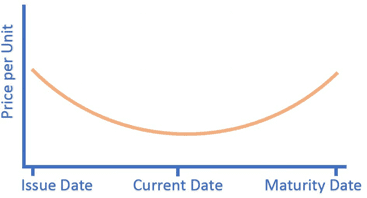

As unfortunate as that is for those that hold those bonds, all is not lost. The impact of the meteoric rise in interest rates may have pushed down the current value of a bond, but those that hold to maturity will still get their dollar back at the end of the day (assuming, of course, that the company is in a position to re-pay the bond – a fair assumption in most cases).

Only those that need to sell on the market will be impacted by the fact that the bonds are trading under-water. The graph of price vs Date shows the theoretical value of a bond that has been impacted by rate rises. The bonds on its issue date will trade at $1 per unit based on the interest rates at the time. As interest rates have risen, the relative attractiveness of the bond has dropped, seeing the price per unit drop. Assuming we’ve seen the worst of the rate rises, we would expect the price of the bond to slowly works its way back to par until it reaches maturity.

For those that do not hold bonds, now is looking like an attractive time to add them to your portfolio. The flip side to the rate rises we’ve seen over the past 12 months is that now the yield to maturity of bonds on the NZX are starting to look far more attractive. The breadth of bonds available at attractive prices makes it an opportune time to build a fixed interest portfolio.

As noted above, there are a plethora of bonds that now trade at a discount to their ‘par’ value, which is $1 per unit. This is due to them being issued when rates were lower than they are now, meaning buyers on today’s market are only prepared to pay 83 cents in the dollar for an Argosy Bond for example.

This means that part of the return you receive will not be paid in coupon/interest payments, but from the capital gain to maturity on offer. So, an investment in 10,000 Argosy bonds will cost you approximately $8,300 (plus brokerage) but you should be paid $10,000 at maturity.

This gain to maturity is a large part of the yield these bonds will generate. They also pay interest on a quarterly or semi-annual basis at the rates quoted below.

All prices are indicative and subject to change based on market movements. The figures are gross (before tax) and do not include brokerage costs.

These bonds are just a small part of the overall debt market and have been selected for illustrative purposes. Please talk to your adviser to discuss your options in this space.