Amid the storm of market volatility in the first half of 2022, health care was among the few areas that offered investors some shelter.

That may not be surprising, considering that demand for services in the sector tend to hold up regardless of market volatility or the economic cycle.

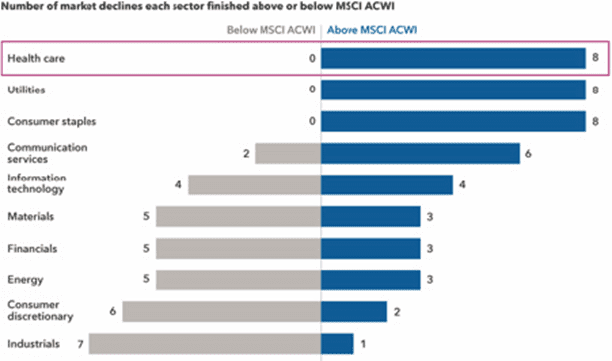

In fact, the sector has outpaced the broader global stock market in each of the past eight market declines of 15% or more.

Indeed, prospects for select companies appear to be brightening, and some have the potential to remain compelling investment opportunities for years to come, according to one equity analyst.

“Health care has been a good place to invest since the start of the pandemic for a variety of reasons,” says Christopher Lee, who covers U.S. pharmaceuticals and biotechnology companies for Capital Group. “First you had biopharma companies developing vaccines and treatments for COVID. Now you have other companies benefiting from their defensive nature in a time of uncertainty in the markets.”

Healthcare is among the sectors that have done well in down markets

“But that’s not the whole story,” Lee adds. “Innovation across drug development, genetic sequencing, data collection and health care service delivery is accelerating. That’s driving growth for nimble companies and generating opportunity for long-term investors.”

This all begs the question: Could the 2020s be the decade when global health care takes a leading role in markets?

Lee identified four reasons why we may be entering a golden age of health care and the potential implications for investors.

We are in the golden age of drug discovery

We are in the early days of a major wave of innovation in biotech and drug discovery.

This is the genetic age of medicine. We have the insights from genetic sequencing done in recent years and a wealth of data, we can now process at rapid speeds, as well as new therapeutic interventions and technologies that can more specifically intervene in the disease process. It’s an incredibly exciting time.

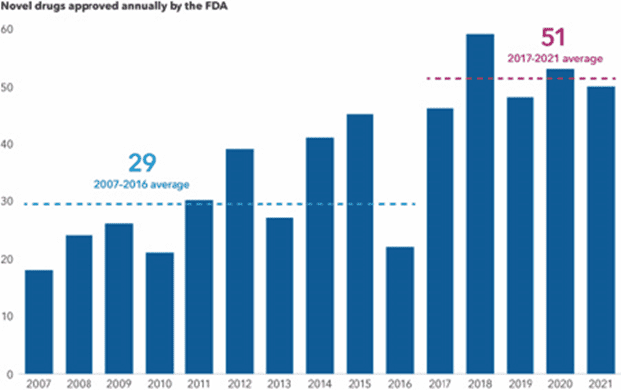

The number of drugs gaining approval has expanded in recent years.

Genetic medicine leads to faster breakthroughs

One key advancement is the development of technologies that allow intervention in disease pathways at the level of the genetic sequence. Through sequencing and data processing, drug developers can apply highly specific and precise interventions like gene therapy, where we transplant normal genes in place of missing or defective ones to address the disease.

To formulate a COVID vaccine with such speed, scientists sequenced the virus within days or weeks of identifying it and then translated that sequence to various vaccines and mRNA. It’s an example of how targeting a pathogen genetically can create an effective medicine very quickly.

COVID became an accelerant for innovation, condensing into two years of work what the industry might have previously needed 10 years to accomplish.

New managed care models in the U.S. improve outcomes and lower costs

The US is seeing a major wave of innovation across drug development, and a new age of innovation on the services side of health care. If you look at how most doctors practice today in the U.S., particularly primary care doctors, they operate in the traditional fee-for-service model, but today, companies are developing models that reward doctors for keeping patients healthy and out of the hospital. This elevates the primary care physician from essentially the bottom of the health care totem pole to the top.

These models are an important step toward achieving what’s often described as the holy grail or quadruple aim in US health care: better health outcomes, higher patient satisfaction, higher doctor satisfaction and lower costs per capita.

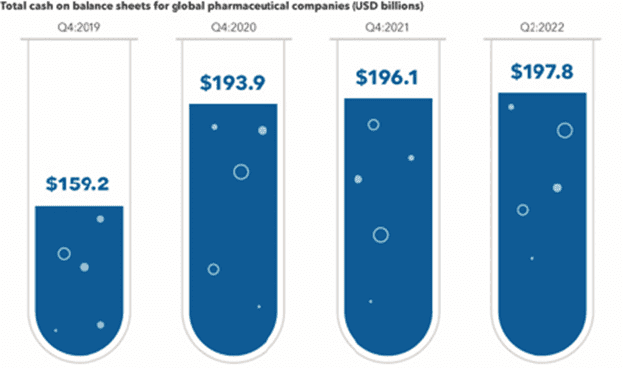

Well-capitalised companies can fund their own growth

Periods of accelerating innovation can produce opportunities for good long-term investments. Innovation has often driven earnings and investment returns over many years. What’s more, many large pharmaceutical companies are well capitalized with a lot of cash on their balance sheets, providing them an opportunity to fund their own growth through acquisitions and other strategies.

Global pharma companies stand ready for mergers and acquisitions.

Ultimately what drives long-term value creation in health care is innovation. Of course, not every innovation will succeed. Some drugs will fail to meet approval or gain market acceptance. But if you identify an innovative product or service that’s special, it has the potential to drive an investment thesis for years. This gets me excited because it can result in real earnings and real cash flows.

I think the health care sector has the potential to emerge as a leader of the next bull market. Call your adviser if you want to know more about what stocks are available to take advantage of the healthcare sector in NZ and globally.

*Article reproduced with permission of Capital Group via Heathcote Investment Partners