COMMERCIAL PROPERTY: COMPELLING VALUE EMERGING AMID EASING MONETARY CONDITIONS

The recent 25 basis point cut to the Official Cash Rate (OCR) by the Reserve Bank of New Zealand (RBNZ), bringing the OCR down to 3.25%, marks a pivotal moment for income-focused investors.

As monetary policy continues to ease in response to slowing global growth and moderating domestic inflation, we believe the current environment presents an increasingly attractive entry point into listed commercial property.

The RBNZ’s forward guidance suggests further cuts are likely, with forecasts pointing to an OCR of 2.92% by the end of 2025. In this context, the yields offered by New Zealand’s real estate investment trusts (REITs) and listed property vehicles stand out.

Why Listed Property Looks Attractive Now

Interest Rate Tailwinds

- Lower interest rates reduce financing costs for property owners and typically compress cap rates, resulting in upward pressure on asset valuations. Listed property vehicles stand to benefit on both the income and capital sides as the cost of capital declines.

Relative Value and Yield Premium

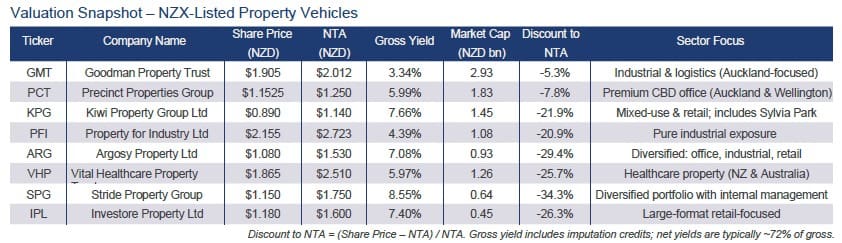

- Listed property trusts are offering gross dividend yields of 6–8%, significantly above term deposit rates and New Zealand Government bond yields. In many cases, these vehicles are trading at steep discounts to Net Tangible Asset (NTA) value, enhancing total return potential.

Economic Normalisation

- Macroeconomic indicators point to a more stabile environment. Inflation has eased to 2.5%, within the RBNZ’s 1–3% target range. Treasury forecasts real GDP growth of 2.9% for the 2026 financial year, supported by infrastructure spending and a recovery in private consumption. As business confidence improves, so too should demand for commercial space.

Defensive Characteristics

- Many listed property portfolios are underpinned by long-weighted average lease terms (WALTs), strong tenant covenants, and fixed rental escalations—characteristics that can provide income stability in uncertain markets.

CONCLUSION

- Valuations across the listed property sector are at compelling levels, with the average discount to NTA exceeding 20% for several key vehicles. Coupled with yields materially above fixed income alternatives and the prospect of capital appreciation driven by falling interest rates, the sector offers a unique combination of income and value.

- We believe investors with medium to long- term investment horizons should consider a diversified exposure to NZX-listed property entities as part of their income strategy. With careful selection, the listed property sector can offer defensive characteristics, reliable cash flow, and potential capital upside in the current macroeconomic environment.

For further discussion on how these opportunities may complement your portfolio, please contact your adviser at Hamilton Hindin Greene.