Key Takeaways

- Infratil plans to acquire Brookfield Asset Management’s stake in One NZ for $1.8 billion, increasing its shareholding from 49.95% to 99.9%.

- The acquisition will be funded through an $850 million equity raise, as well as $950 million from cash reserves and debt facilities.

- CEO Jason Boyes believes the increased investment aligns with Infratil’s strategic and financial objectives, highlighting One NZ’s strong momentum and growth potential.

- To support the acquisition, Infratil intends to raise $750 million through an underwritten placement and offer an additional $100 million to retail investors.

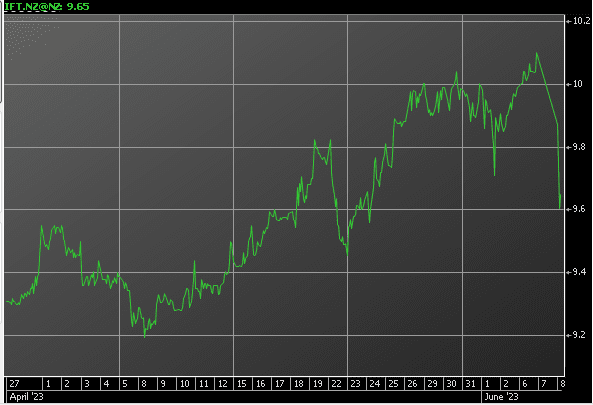

- The placement involves issuing 81.5 million new shares at $9.20 per share, representing an 8.9% discount to the closing price. The retail offer closes on June 27.

- One NZ CEO Jason Paris sees Infratil’s investment as a vote of confidence in the company’s plans, leading to One NZ becoming 100% locally owned and managed.

- The deal values One NZ at an enterprise value of $5.9 billion.

Extended Summary

Infratil has unveiled its intentions to purchase Brookfield Asset Management’s stake in One NZ for $1.8 billion. This strategic move will boost Infratil’s shareholding in One NZ from 49.95% to 99.9%. The acquisition will be funded in part by an $850 million equity raise, along with $950 million from cash reserves and debt facilities.

Jason Boyes, the CEO of Infratil, expressed that the increased investment in One NZ aligns with the company’s strategic and financial objectives. He highlighted the strong momentum of One NZ following recent rebranding and ongoing business transformation initiatives, anticipating further growth opportunities.

To support the acquisition, Infratil plans to raise $750 million through an underwritten placement, while an additional $100 million will be offered to retail investors. The Australian Stock Exchange (ASX) and the New Zealand Stock Exchange (NZX) have granted a trading halt to facilitate the placement process.

The placement will involve the issuance of 81.5 million new shares (equivalent to 11.2% of the existing issued capital) at $9.20 per share, representing an 8.9% discount to its recent closing price of $10.10. The retail offer is set to close on June 27.

Under the retail offer, existing Infratil shareholders in New Zealand and Australia will have the opportunity to acquire shares, with limits of up to $80,000 and A$45,000, respectively.

Jason Paris, the CEO of One NZ, expressed his enthusiasm for Infratil’s investment, considering it a significant vote of confidence in the company’s plans. He emphasized that this transaction would result in One NZ becoming 100% locally owned and managed for the first time.

The deal values One NZ at an enterprise value of $5.9 billion.