The last quarterly meeting was held on the 1st of December.

We discussed the most recent reporting season, which saw aged care come under the spotlight. Aged care has been a difficult area for investors lately as property prices have dropped and sales volumes have slowed down. The sector is also struggling with increased costs and a lack of free cash flow. The Committee noted that advisers should consider the income requirements of their clients when making recommendations in the sector, as dividends will likely be truncated for a number of years.

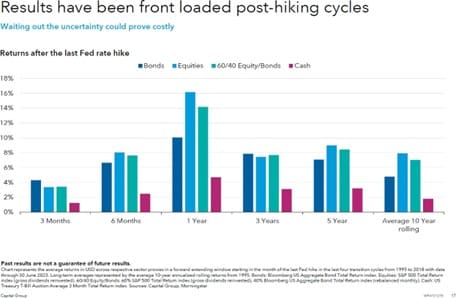

Looking forward, the committee noted a recent presentation HHG had by Capital Group. They noted that earnings growth had begun to trend back upwards again after dropping in 2022, and early 2023. Another aspect of the Capital Group presentation we discussed is how markets react to dropping interest rates. The table below shows that the market has historically performed very well in the year following the last US Federal Reserve rate hike (markets have been moving up in the last couple of months, as it appears we may have already seen the last rate hike).

The Chief Economist at Betashares, David Bassanese, joined the Committee via video conference from Australia. He shared data showing that inflation is coming down and that the market is beginning to price in rate cuts next year (in the US).

He also echoed Capital Group’s thoughts around earnings growth, showing that they are on a recovery track in both Australia and the US (data for New Zealand was not available; however, we expect the same recovery to be taking place here). He noted that the US market valuations were a touch on the high side (unsurprising given the US market has significantly outperformed both the ASX and NZX over the last couple of years), but the ASX valuations were a touch below their long-term average (when controlling for long-term interest rates).

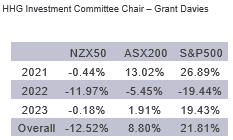

I would like to thank all HHG Investment Committee members for their work this year, particularly our independent members. The HHG Investment Committee has been instrumental in ensuring our clients have included more global assets in their portfolios, something that has helped many managed portfolios weather the last few years, while the NZX50 has significantly underperformed global markets.

The table below shows the relative underperformance of the NZX50 over the last 3 years. Clearly, portfolios have benefited from having some overseas exposure. These figures do not include the tailwind investors in the US have received from the weakening NZD, which has helped boost US domiciled returns in NZD terms.