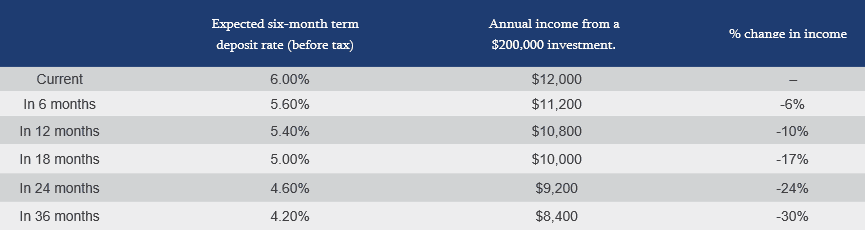

Term deposits are currently riding near a 15-year peak, offering investors a temporary high. However, this upward trend is not projected to endure. The accompanying table lays out a clear picture, showcasing the anticipated annual returns from term deposits over the next three years, revealing a significant downward trajectory in interest rates. As a result, savvy investors are prompted to reassess their investment approaches, venturing into alternative avenues such as the New Zealand debt and share market. Exploring these options allows for diversification and opens doors to potentially greater returns over the medium to long term, presenting a compelling case for strategic portfolio adjustments.