This quarter’s jargon buster is focused on helping investors better understand credit ratings.

Credit ratings are issued by specialist credit rating agencies, they include Standard & Poor’s, Moody’s, and Fitch. Standard & Poor’s are one of the most frequently cited credit rating agencies in NZ for new issues of debt & equity securities. On this basis, we have focused this article on the Standard & Poor’s credit rating process.

Issuers, including corporations, financial institutions, national governments, states, cities, and municipalities, use credit ratings to provide independent views of their creditworthiness and the credit quality of their debt or equity issues.

In forming their opinion on credit risk, credit rating agencies use analysts and mathematical models. The process begins with an issuer requesting a credit rating from one of the big three credit rating agencies. They pass through an initial evaluation; analysts meet with management and evaluate the company. A rating committee will review the analysts’ work and vote on a credit rating. The credit rating will be communicated to the issuer, released publicly, and kept under surveillance by Standard & Poor’s.

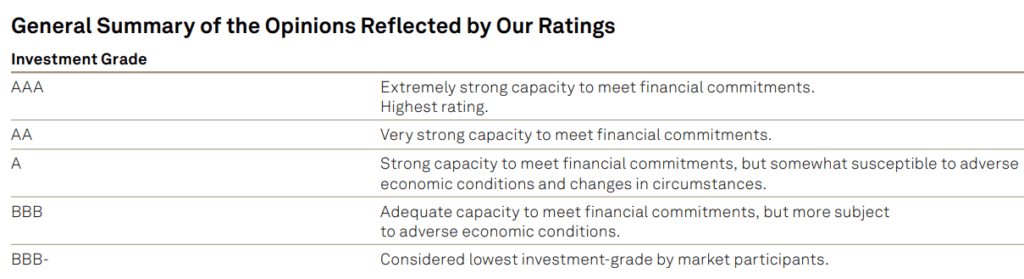

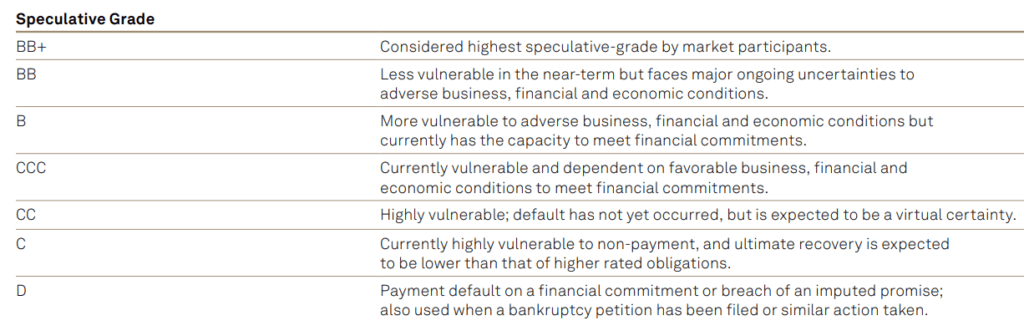

The Standard & Poor’s credit ratings have been broadly summarised below.

The term “investment-grade” historically referred to bonds and other debt securities that bank regulators and market participants viewed as suitable investments for financial institutions. Now the term is broadly used to describe issuers and issues with relatively high levels of creditworthiness and credit quality.

At Hamilton Hindin Greene, we prefer to limit our recommendations to investment grade credit rated securities. Fixed interest securities represent the defensive component of your portfolio, so they will ideally have a high credit rating to reflect a lower level of credit risk.