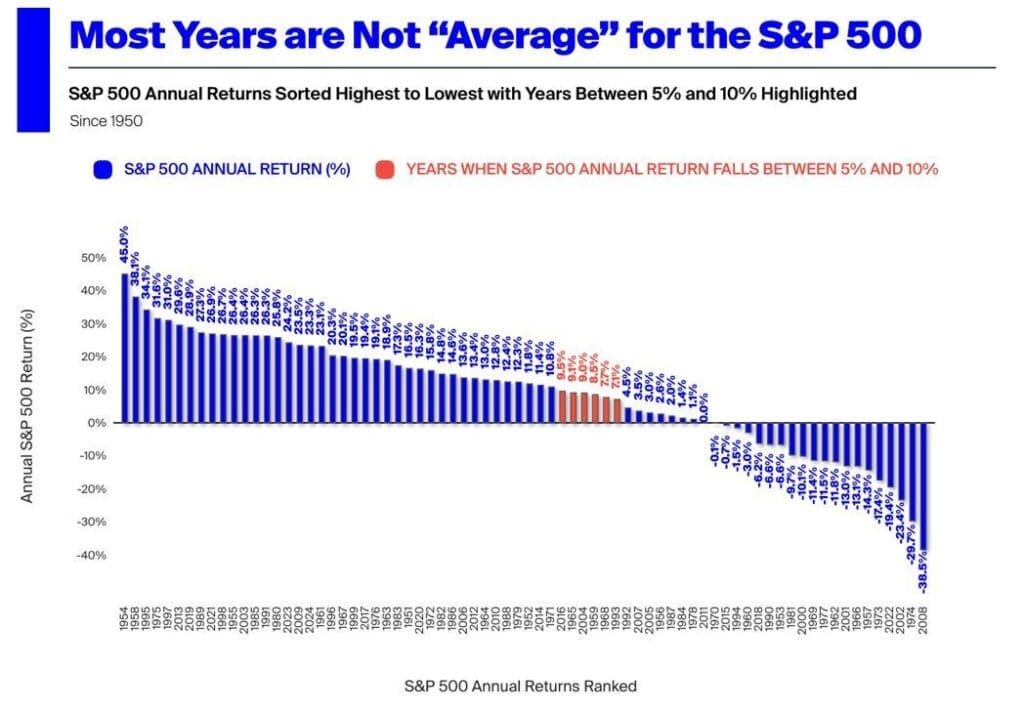

A KEY LESSON FROM 75 YEARS OF S&P 500 DATA

Don’t expect 5-10% annual returns from a single investment. Most years aren’t “average.”

Below we’re looking at a chart of the S&P 500’s annual price return in all years since 1950. The bars are sorted from highest annual return to lowest.

❚ Red bars had “average returns” of 5-10%.

❚ Blue bars fell outside the 5-10% “average return” bucket. There’s 11x as many blue bars on this chart as red.

The good news is that a well-constructed and diversified portfolio can help smooth out these peaks and troughs.

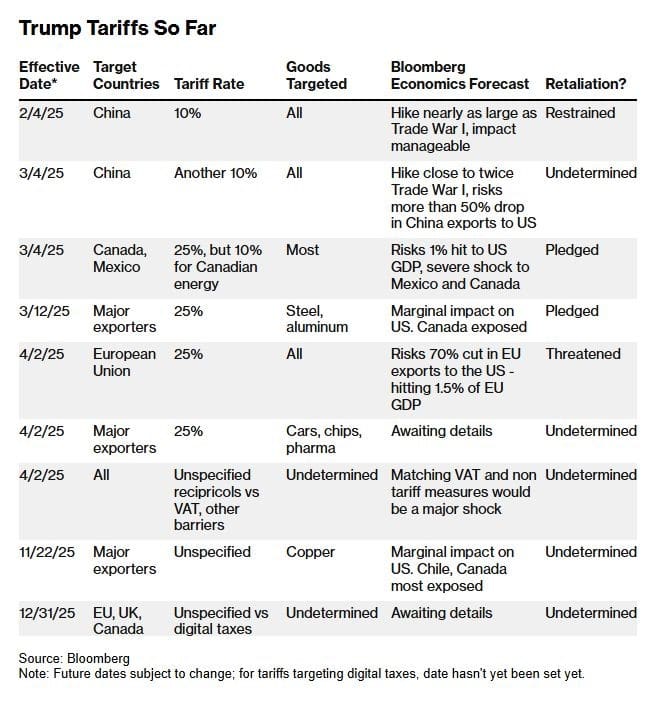

THE IMPACT OF US TARIFFS

NVIDIA

Nvidia has once again exceeded market expectations, posting Q4 revenue of $39.33 billion (vs. $38.05B expected) and EPS of $0.89

(vs. $0.84 expected). More importantly, its guidance for Q1 FY25 at $43B signals continued dominance in the AI accelerator market. The numbers are staggering:

- Revenue up 78% YoY

- Net income nearly doubled to $22.09B

- Data center revenue surged 93% YoY to $35.6B, now 91% of total sales

With AI driving unprecedented demand, Nvidia’s upcoming Blackwell chips will be crucial in maintaining momentum. The market, however, remains cautious – shares were flat post-earnings.