Key Takeaways.

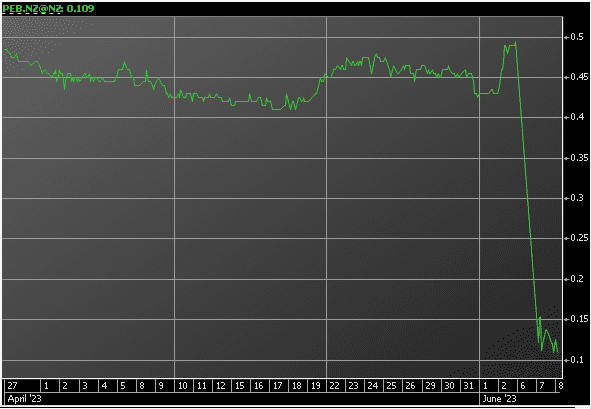

- Pacific Edge’s stock plummeted by 89.9% following the decision that Medicare coverage of Cxbladder tests in the US would cease from July 17.

- The loss in market value amounted to $360.6 million, significantly reducing Pacific Edge’s worth to $40.5 million according to investors.

- Pacific Edge plans to explore all available legal options, including a potential appeal, with the assistance of its US-based lawyers in response to the Medicare coverage decision.

- The company expects a substantial reduction in revenue until Cxbladder tests regain coverage, as Medicare and Medicare Advantage tests accounted for approximately 60% of US commercial tests and 77.3% of the company’s annual operating revenue.

- Pacific Edge will continue promoting Cxbladder, processing tests ordered by US clinicians, and evaluating its strategy while implementing cost containment measures. The company maintains confidence in its long-term opportunities and pledges updates as it formulates its strategic path forward.

Extended Summary:

Pacific Edge’s stock plummeted by 89.9% following the announcement that Medicare coverage of Cxbladder tests in the US would cease from July 17. After a temporary halt, trading resumed at a mere 5 cents per share, down from 49.5 cents. This drastic decline resulted in a loss of $360.6 million in market value, reducing Pacific Edge’s worth to $40.5 million according to investors.

In response to this development, Pacific Edge intends to explore all available legal options, including a potential appeal, with the assistance of its US-based lawyers. Novitas, the Medicare administrative contractor, issued a “local coverage determination,” indicating that Pacific Edge’s suite of products fails to meet the coverage requirements outlined in the US Social Security Act.

As a direct consequence of this decision, Pacific Edge anticipates a significant reduction in revenue until Cxbladder tests regain coverage. In the fiscal year ending March 2023, tests for Medicare and Medicare Advantage accounted for approximately 60% of US commercial tests, equivalent to around 13,800 tests. These tests contributed $15.3 million, representing 77.3% of the company’s annual operating revenue.

Pacific Edge currently cannot fully ascertain the impact of this decision on test volumes in the US market for the 2024 financial year. Nonetheless, the company deems it prudent to continue supporting Cxbladder in the short term while implementing cost containment measures, including an immediate hiring freeze and a halt on discretionary spending and new capital expenditure.

In the meantime, Pacific Edge will continue to promote Cxbladder and process tests ordered by US clinicians. Simultaneously, it will evaluate its strategy and explore future options. The company emphasizes that private healthcare payers in the US make independent medical policy decisions, and it expects uninterrupted billing and reimbursement from contracted US payers, as well as non-contracted private payers based on historical reimbursement rates. Notably, its largest US customer, Kaiser Permanente, plans to continue payment for Triage and Monitor products regardless of the Novitas determination. Similarly, reimbursement is expected from the US Veterans Administration and other direct billpayers for a small portion of insured patients.

Pacific Edge’s management and board are actively considering various alternatives, including legal challenges or appeals, regaining coverage through Novitas, securing coverage through an alternative contractor, or implementing alternative billing practices that would increase patient responsibility. They are open to other possibilities as well. The company assures stakeholders that it maintains a solid financial position with $77.8 million in cash, cash equivalents, and short-term deposits as of the end of March 2023, as stated by Chair Chris Gallaher.

Despite the current setback, Pacific Edge remains confident in its ability to capitalize on significant opportunities for Cxbladder in the US and worldwide. The company pledges to provide updates to the market as it gains greater clarity and formulates its strategic path forward.