The month of May saw Richard visiting family in the UK, who fortunately live close to Edinburgh which presented him with an ideal opportunity to visit Stewart Heggie, Investment Director, and Grant Walker, Head of Intermediary Sales at Baillie Gifford for a further update on developments at the Scottish Mortgage Trust. As it had been three months since our video conference it was a nice opportunity to see if there had been any developments of note.

Essentially it is “business as usual” for Scottish Mortgage. There had been some negative press regarding a director who had left but steps had been taken to strengthen the board. Portfolio wise, they still have a number of unlisted companies in the portfolio but Baillie Gifford are confident in their choices and

have no plans to deviate from their investment strategy.

The meeting provided us with further reassurance that Scottish Mortgage is still a sound investment to hold, despite the falls of the last 18 months, and falling interest rates will provide more support for the portfolio which is currently sitting at a 20% discount to net asset value.

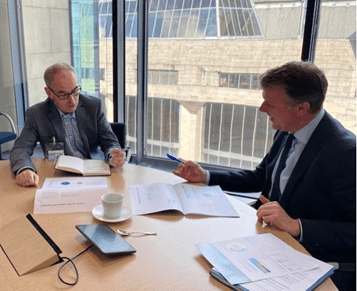

A further visit to London saw Richard meet with Andrew Pease, Global Head of Investment Strategy, and Gary Yeaman, Investment Director at Russell Investments for their view of the world.

Andrew provided his view of the world markets in general. His main concern at the time of our meeting was when the revised US debt ceiling would be signed off, but despite that he stated that the preferred strategy at Russell was to buy and hold a mixture of high-quality equities and bonds with good

income or dividend yields, and hold for the longer term. A strategy which we at Hamilton Hindin Greene wouldn’t argue against.

As a personal insight Richard said that retail is really struggling in the UK. Lots of boarded up shops were apparent and online retailers such as Amazon are taking a large slice of consumer spending there. Construction seems to be booming though – Richard was in London in March of 2020 and in just three years the number of new buildings was very apparent. We do wonder who is going to be occupying them all though…