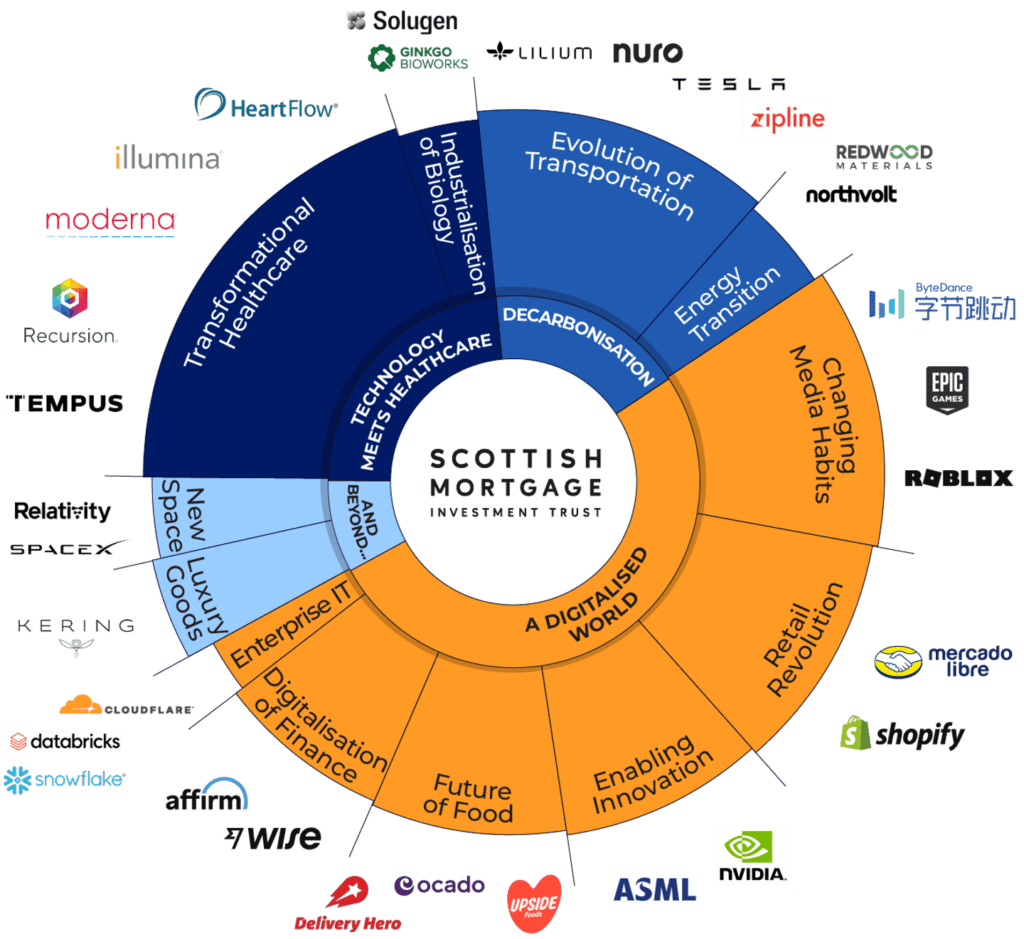

Many investors in the trust will no doubt be concerned about the falls in the share price over the last 12 months and Baillie Gifford provided an overview of the current situation, and future course of action. Despite the name, the Trust invests in Global growth companies with a high exposure to technology assets. Names within the portfolio include Moderna (vaccines) Tesla (electric vehicles) Northvolt (battery technology) SpaceX (satellite launches) and Upside Foods (cultivated meat products). The main themes for the Trust remain technology, decarbonisation, and digitalisation. The portfolio consists of around 100 stocks, 70 of which are listed, 30 are private, and all are held for long term growth potential. The graphic here shows the current portfolio constituents:

The Technology sector has struggled over the last year, but one key issue has been the lack of IPO’s in 2022. In order to liberate the value and profit within a private company, the company will need to either be subject to a management buy-out, sold to a trade buyer, or listed on the stock market. Difficult conditions have prevented Baillie Gifford from releasing these profits for the portfolio but as conditions improve the market for public offerings will also improve. Certain companies like Il lumina and Netflix have also enjoyed strong performance but in the case of Illumina it is less clear what new Gene sequencing developments will arise in future, and how new competition could affect their position.

There are some questions regarding Netflix, will get a second wind or is the market for streaming services now saturated? Changing regulatory and geopolitical issues regarding China have also has an effect with the Trust reducing exposure to the Chinese market over the last two years. Scottish Mortgage Trust also incorporates gearing, meaning they can borrow money to take larger positions in conviction stocks. This works well in rising markets but can accentuate losses in falling markets.

At the moment the stock doesn’t meet our investment committee criteria owing to the current gearing levels which are higher than we prefer. The strategy for the Trust is to invest in new industries and that has not changed. Whilst market conditions have not been helpful to these companies, Baillie Gifford remain confident and optimistic and as market conditions settle and normalise, Scottish Mortgage should be well placed to take advantage. There have however been concerns raised at the Board level by Amar Bhidé who has been a non-executive director on the board of the Scottish Mortgage Investment Trust since 2020. He raised issues in a Board stoush about the trust’s exposure to private assets, saying “it did not have the resources and governance to monitor these investments”. In response, Fiona McBain, chairperson of the trust’s board said: “I have complete confidence that Scottish Mortgage’s Board provides robust governance and oversight. Current topics such as short-term volatility and the Company’s exposure to private companies have been debated at length and will continue to be scrutinised by the Board”.

The Board has confirmed that the managers are taking the right long-term investment approach and building a portfolio of exceptional growth companies that have delivered over the last 10 years and can continue to deliver for shareholders over five years or more. The trust currently has 26 per cent of its portfolio in private companies, just below its own limit of 30 per cent. Baillie Gifford has seen its assets under management drop by more than £100mn last year as a result of the impact of higher interest rates on these growth companies.

Hamilton Hindin Greene will continue to monitor and update investors of the Fund. Your adviser is happy to discuss your holding and will continue to assess whether the fund remains appropriate for you on review.