Warren Buffett Steps Down

BUT HIS GOLDEN RULE FOR INVESTING STILL STANDS

After decades at the helm, Warren Buffett has officially stepped down as CEO of Berkshire Hathaway, marking the end of an era. Known as the “Oracle of Omaha,” Buffett built a legacy not just on performance, but on timeless investing wisdom. And while leadership may change, his core principles remain as relevant as ever.

Warren Buffett’s Golden Rule: Don’t Lose Money

Buffett famously summed up his investing philosophy with two simple rules:

-

- Rule #1: DON’T LOSE MONEY.

-

- Rule #2: NEVER FORGET RULE #1.

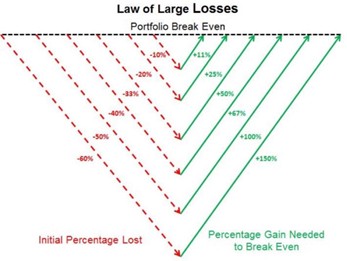

It’s a deceptively simple message, but the logic is powerful. Losing money sets you back much further than you think. For example, a 50% loss in your portfolio means you need a 100% gain just to break even. That kind of recovery can be a long and difficult road.

That’s why Buffett’s approach prioritises capital preservation above all else. He looks for high-quality businesses, bought at sensible prices, with strong balance sheets and honest management. He avoids speculative trends and focuses on what he understands, an approach built on patience, discipline, and long-term thinking.

For investors, the lesson is clear: before chasing high returns, make sure you’re not exposing yourself to unnecessary risk. In uncertain markets, sometimes the best move is simply to protect what you’ve already built.

As Buffett steps back, his rules remain a compass for long-term investors: simple, grounded, and proven over time.