We’ve all heard the sayings, wise words like “buy low, sell high” and “be fearful when others are greedy and greedy when others are fearful”. The problem is that investors aren’t (usually) machines and investor psychology means the chances are much higher that the opposite will happen. This is because people are far more likely to buy when things seem good, or the “time is right”. Likewise, people are much more likely to sell when economic conditions have deteriorated and consumer confidence is low (if people don’t think now is the right time to fund a big purchase like a new car or kitchen remodel, then they probably don’t think the time is right to buy shares in a business either). This is the very reason why the share markets are rising or falling in the first place – many more buyers or sellers at any one time.

The problem with this is that unless those investors have a crystal ball, share prices will have reacted well before the economy begins to feel the effects of good or bad conditions. This is because the share market prices in what it believes will happen in the next year or so and means if you are buying shares when conditions are “good”, you are probably buying at very high prices, and if you are selling when conditions are “bad”, then there’s a good chance you’re selling shares at less than they are worth. Right now in NZ is a perfect illustration of this – share markets began falling when the economy was roaring along, and it is only now when markets have fallen quite far that the economy is starting to wobble.

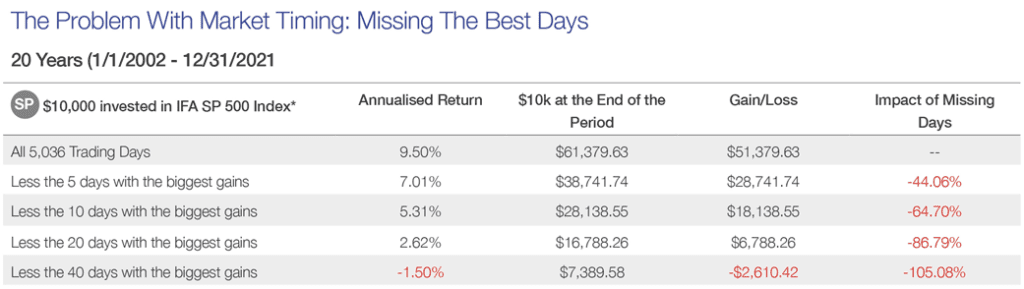

Now in a perfect world, we would be able to sell at or near the top, wait for the market to bottom out, then buy back in again. The reason this almost never works is due to how close the worst days are to the best days. Using the S&P500 as an example, there have been six times since 2000 where the index has fallen 15% or more, with the average fall being -32.5% and the average time from top to bottom being 10 months. Every single time the market recovered to go much higher, and when it did, it recovered very quickly. The average 1 month return from the moment the share market bottomed was +17.3%. After 3 months, the average return was +24.6% and a year after the average return was +46.2%. The graph below shows the difference in return if you had missed some of the best days over a 20 year period. It’s quite astonishing to see that, on average, the best two days each year are the difference between annual returns of positive 9.5% per year and negative 1.50% per year.

What makes timing even harder is the amount of “false starts” on both the way down and way up. The share market falls over 10% relatively regularly (called a “correction”) but we never know in advance whether it will recover immediately, continue falling then recover, or recover and fall multiple times before finally recovering for an extended period. Likewise, there are multiple times we think the market has bottomed and begun its quick recovery, only for the market to fall below its previous low again.

These things combine to mean that picking the top and the bottom consistently is almost impossible and the risk of missing out on the recovery isn’t worth the benefits of trying to avoid part of the fall.

No one knows when the market will bottom and when the recovery will begin, but there’s only one way to be a part of it; own shares before it starts.