We can all agree that Climate Change, societal inequality, and human rights abuses are a disappointing reality of economic progress, and while our individual actions may not appear to effect material change, collectively we have the opportunity to make an impact through our consumption decisions, and more importantly, with our investment decisions.

Progressive companies with ethical businesses practices are fast becoming the norm, driven by consumer demand to understand the impact a business’ supply chain has on the environment, society, and the diversity within a company’s governance structure (ESG). Consumer behaviour is a leading driver of the products and services companies offer to their customers, and while this remains a constant, the consumer decision making process is placing a larger weight on the nature of a companies’ business practices and their approach to addressing ESG issues. Companies that choose to ignore these realities are the equivalent of salmon swimming up stream; aptly termed temporary companies.

As a business, we have noticed a growing number of clients actively requesting investments that are ethical in nature, along with providing a list of industries that are off limits for investment. Fortunately, consumer behaviour has not only driven business to adopt more ethical business practices. This has also increased the number of investment options issued by the larger investment managers such as US domiciled BlackRock via their exchange traded fund (ETF) business iShares and Australian listed ETFs via Betashares. Responsible investments in New Zealand now represent $142 billion, or 43% of the country’s professionally managed funds and they are fast gaining furthermarket share.

Ethical investing has been split into a few different camps, negatively screened funds, and responsible investment funds/impact funds. A negatively screened investment fund or ETF will often utilise an existing ‘unethical’ fund or an index such as the S&P500 and apply a negative screener to the components of that fund to screen out any companies that are regarded as being ‘negative’ or ‘unethical’. This screener may look to exclude tobacco, gambling, fossil fuels, etc, just to name a few of the more commonly screened industries. For example, the BetaShares Global Sustainability Leaders ETF screens for fossil fuel producers, companies significantly engaged in armaments, gambling, alcohol or junk foods, companies with no gender diversity at the board level, companies with human rights or supply chain issues, animal cruelty, and numerous others. Impact/Responsible investing approaches the subject of ethical investing from the perspective of investing in companies that have a positive impact, along with applying a negative screener as described above. The process for achieving a positive impact and the definition of positive impact will vary between investment funds.

The iShares MSCI Global Impact ETF

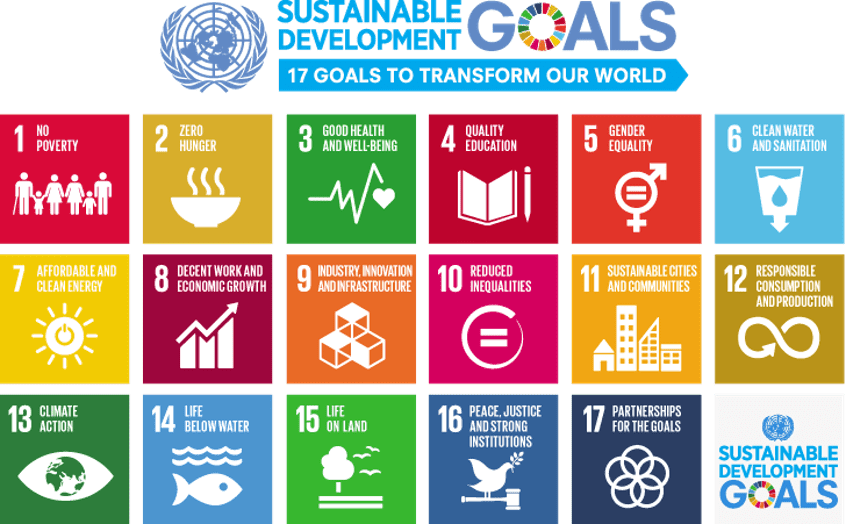

The iShares MSCI Global Impact ETF (SDG) defines a positive impact company as one that derives a majority of their revenue from products and services that address at least one of the world’s major social and environmental challenges as identified by the United Nations Sustainable Development Goals. The UN Sustainable Development Goals (SDGs) are the world’s shared plan to end extreme poverty, reduce inequality, and protect the planet by 2030.

Impax Environmental Markets

Another example of an impact fund is a listed managed fund called Impax Environmental Markets Plc, this fund seeks to achieve sustainable, above market returns over the longer term by investing globally in companies active in the growing Resource Efficiency and Environmental Markets. These markets address a number of long term macro-economic themes: growing populations, rising living standards, increasing urbanisation, rising consumption, and depletion of limited natural resources. Investments are made in ‘pure-play’ small and mid-cap companies which derive more than 50% of their underlying revenue from sales of environmental products or services in the energy efficiency, renewable energy, water, waste and sustainable food and agriculture markets.

The options available are almost endless, so we have short-listed a few ethical exchange traded funds listed in Australia and the USA that may be of interest. These include the BetaShares Australian Sustainability Leaders ETF (FAIR) for Australian equities exposure, and for global exposure, we like the following ETFs, Betashare Climate Change Innovation ETF (ERTH), BetaShares Global Sustainability Leaders ETF (ETHI), iShares Global Clean Energy ETF (ICLN), and iShares MSCI Global Impact ETF.

The BetaShares Australian Sustainability Leaders ETF (FAIR) and BetaShares Global Sustainability Leaders ETF (ETHI) are Australian listed funds that provide well-diversified exposure to companies that meet strict sustainability and ethical standards. The key differentiating factor between the two funds is that FAIR holds Australian listed companies and ETHI holds global listed companies. The Funds’ methodology preferences companies classified as “Sustainability Leaders” based on their involvement in sustainable business activities. The largest three industry concentrations for FAIR include healthcare (27%), real estate (19%) and financials (17%), while ETHI’s largest three industry exposures are information technology (42%), healthcare (16%), and financials (15%).

| Ethical Funds | FAIR.AU | ERTH.AU | ETHI.AU | ICLN.US | SDG.US |

| Inception Date | Nov-17 | Mar-21 | Jan-17 | Jun-08 | Apr-16 |

| Net Assets (local currency) | $1.2 Bn | $135m | $1.8 Bn | $6 Bn | $566m |

| Expense Ratio (p.a.) | 0.49% | 0.65% | 0.59% | 0.42% | 0.49% |

| One Year Gross Return (p.a.) | 23% | – | 35% | 89% | 48% |

| Three Year Gross Return (p.a.) | 11% | – | 26% | 41% | 22% |

| Five Year Gross Return (p.a.) | 0% | – | – | 24% | 18% |